Cash Flow

Cash Flow Challenges Unique to Cannabis Retail

An explanation of why cash flow is often the hardest problem in cannabis retail, even for profitable dispensaries, and what makes regulated markets fundamentally different from traditional businesses.

Article Summary

- Cash flow constraints exist even in profitable cannabis dispensaries

- Banking, tax timing, and inventory cycles create structural pressure

- Traditional cash flow assumptions often fail in regulated retail

- Operational discipline is required to stabilize cash over time

Reality

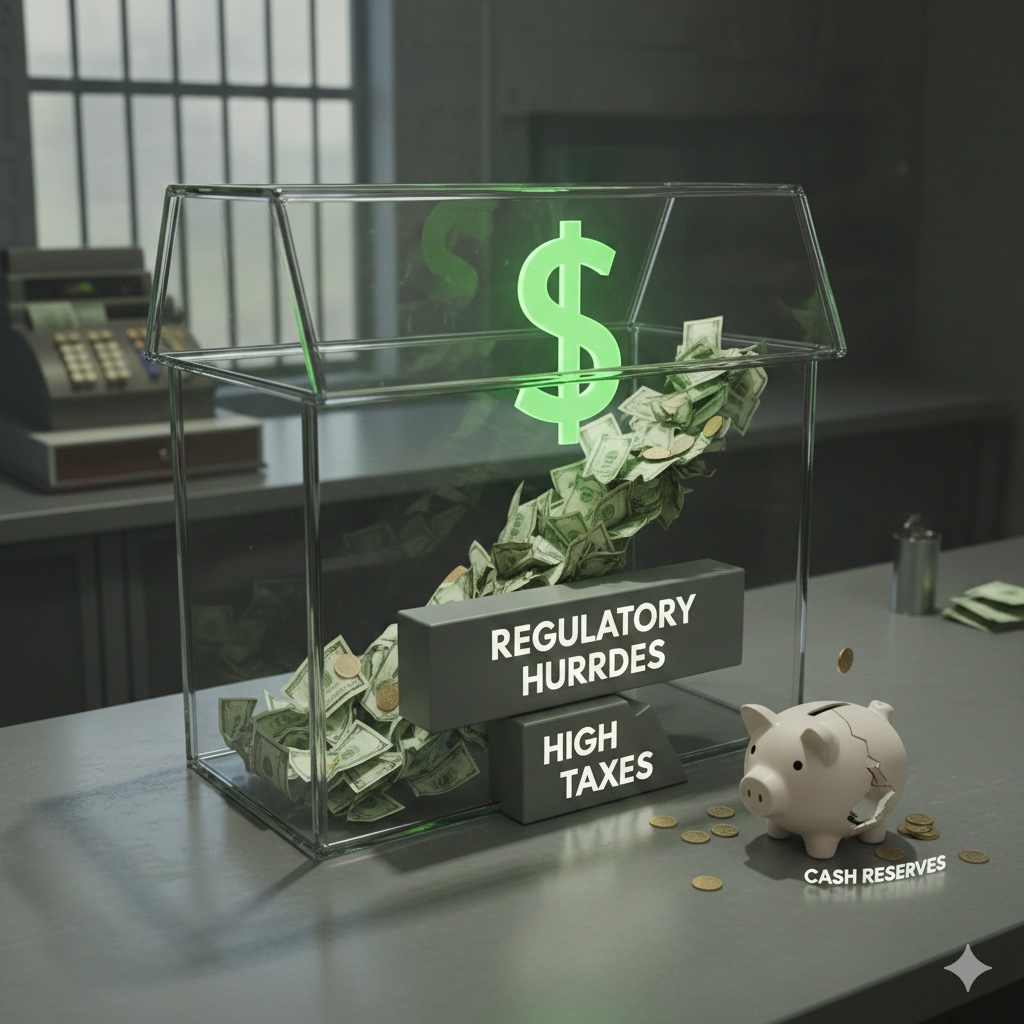

Why Profitable Dispensaries Still Feel Cash Constrained

One of the most counterintuitive aspects of cannabis retail is that a dispensary can be profitable on paper and still feel consistently short on cash.

Revenue may be strong, margins may look reasonable, and demand may be steady.

Yet cash availability remains tight due to the timing and structure of expenses unique to regulated cannabis.

This disconnect surprises many first-time operators.

Banking

Limited Banking Changes Cash Behavior

Cannabis operators often operate with restricted access to traditional banking tools.

Delays in deposits, limits on credit, and reduced access to short-term financing increase reliance on internal cash.

Without standard lines of credit, dispensaries must self-fund inventory, payroll, and tax obligations.

This amplifies the impact of any operational inefficiency.

Inventory

Inventory Ties Up Capital

Inventory purchasing in cannabis often requires upfront cash outlays.

Product must be purchased, received, and carried before revenue is realized.

Slow-moving inventory or overbuying can lock up cash that would otherwise support operations.

Inventory discipline becomes a core cash management function.

Taxes

Tax Timing Creates Pressure

Tax obligations in cannabis retail often occur on fixed schedules that do not align with cash inflows.

Operators must plan for significant payments regardless of short-term performance fluctuations.

Unlike many traditional businesses, cannabis retailers have limited flexibility to smooth tax-related cash demands.

Poor planning around tax timing is a common cause of cash stress.

Operations

Operations Directly Impact Cash Availability

Staffing levels, throughput speed, shrinkage, and compliance errors all affect cash.

Even small operational inefficiencies compound when banking and credit options are limited.

Strong operations reduce cash leakage and improve predictability.

In cannabis retail, cash flow is as much an operational outcome as a financial one.

Discipline

How Experienced Operators Approach Cash

Operators who stabilize cash flow focus on conservative assumptions and tight controls.

Inventory is managed carefully, expenses are timed deliberately, and buffers are maintained.

Rather than optimizing for peak performance, they prioritize resilience.

This approach supports long-term sustainability in volatile environments.

-

CashPrimary operating constraint

-

InventoryLargest cash sink

-

TaxesFixed timing pressure

-

OperationsMain lever for stability